*With our consulting and research projects expanding to cover more companies, new Robo-advisors are added monthly*

|

What is a Robo-Advisor?

Robo-advisors are digital platforms that provide automated, algorithm-driven financial planning services with little to no human supervision. The technology is an alternative to traditional financial advisors and is usually a cheaper option. A typical robo-advisor collects information from clients about their financial situation and future goals through an online survey and uses the data to offer advice and automatically invest client assets.

- Robo-advisor offerings from most wealth management firms are far from satisfactory.

- Unfortunately, most Robo-advisors today are based on flawed diversification research and lack of intelligence to outperform the benchmark.

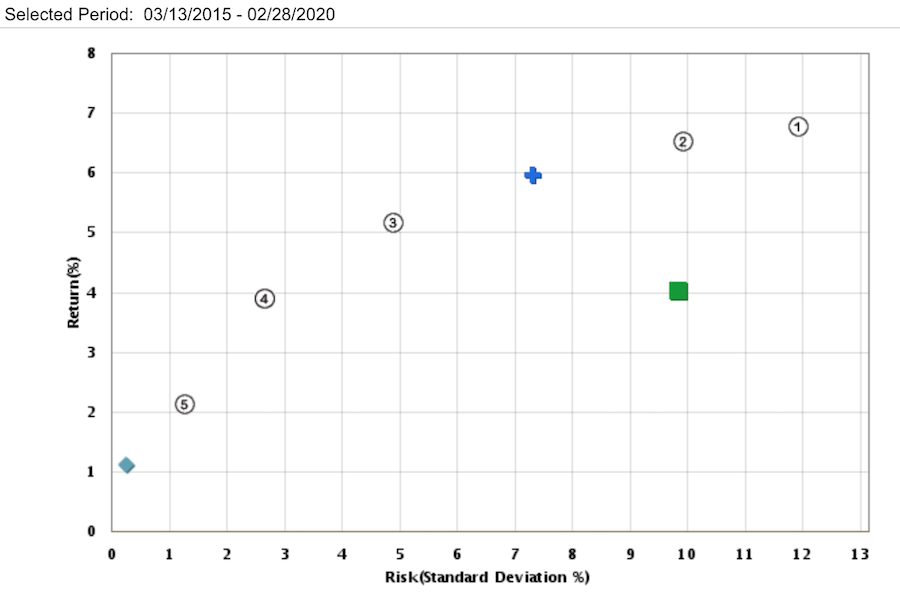

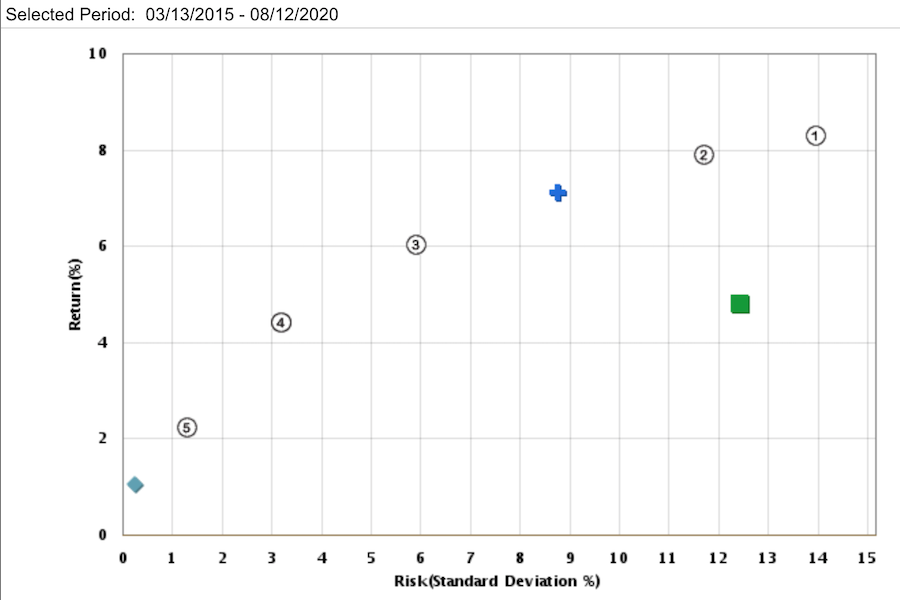

- Shown below is a shocking and actual example of how a well-known Robo-advisor performed before and after the most recent Covid-19 crisis period since inception.

Robo-Advisor Assessment Criteria

- Intelligence - how does it incorporate machine learning, data analytics, Fuzzy-logic, AI rules, and intelligent customization?

- Automation - how well it does asset allocation, rebalancing, computing efficiency, platform compatibility, and fund addition?

- Cost - what is the competitiveness and simplicity of fee structure, and what is the cost for the Robo services with human-touch?

- Performance - what is the strategy underlying the Robo-advisor in terms of transparency, GIPS, benchmarking, historical chart, and management experience?

- Simplicity - how intuitive the Robo-advisor is in its user interface, navigation, educational information, mobile-App, and customer support?

- Conflicts - how does the Robo-advisor select internal vs. best 3rd-party ETF holdings, allocate cash, avoid conflict, PFOF trading disclosure, and enforce account minimum?

- Profiling - how well the Robo-advisor offers financial planning guidance, what-if analysis, risk tolerance questionnaire, goal setting, and behavior coaching?

- Liquidity - how well the Robo-advisor processes fund withdraws, tax-aware income, auto distribution, auto-RMD, and money transfers?

- Research departments and consultants to every wealth manager, retirement plans, and insurance companies are consistently seeking strategies and products aimed to do a better job.

- We are committed to helping investors and firms in researching, reviewing, and designing the best Robo-advisory services.

- Please contact us at AFIEA (Advisory for Financial Innovation, Evaluation, and Assessment) for identifying the areas for improvement and designing better Robo-advisors for the future.

- Based on the above-defined Robo-advisor assessment criteria, we have closely worked with, researched, followed, analyzed, evaluated, and reviewed the following Robo-advisor offerings in the market today. Detailed analysis reports on Robo-advisory competitive market landscape and each listed Robo-advisor are available to financial institutions upon request.