|

What is An AI-Powered ETF?

An AI-power ETF is an actively managed exchange-traded fund that has a manager or team making decisions on the underlying portfolio allocation. Such an ETF will have a benchmark index, but managers may change sector allocations, market-time trades, or deviate from the index as they see fit. It produces investment returns that outperform but do not perfectly mirror the underlying index.

- The future of ETF innovation will expand the investment opportunity set, reduce investment costs, and outperform its respective benchmark with data-driven intelligent algorithms.

- Asset allocation ETFs offer a simple way to build a diversified portfolio for investors. When such ETFs are powered data-driven intelligent algorithms, they become AI-powered ETFs.

- AI-powered ETF innovation has just started in recent years. While the performance of leading ETFs are promising, the choices are still limited.

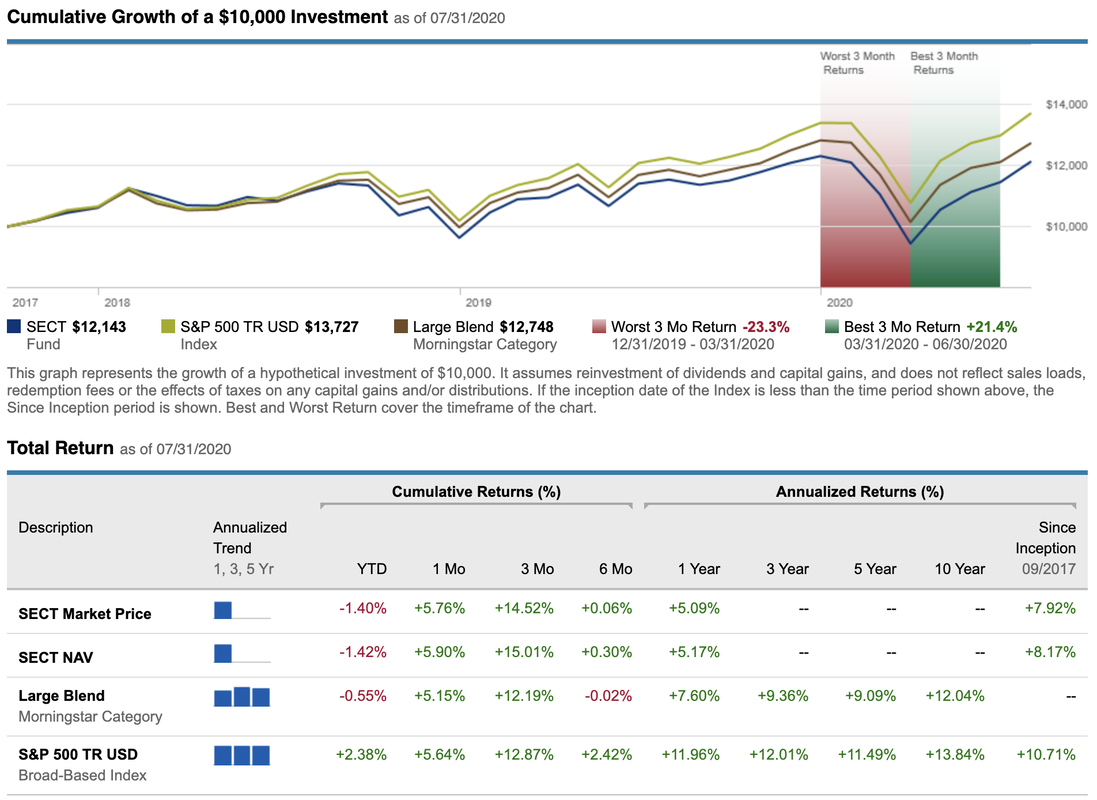

- Some results are far from satisfactory when they are compared to benchmarks. For example, a well-known ETF (symbol: SECT) utilizing a dynamic sector rotation strategy did poorly (shown below).

AI-Powered ETF Assessment Criteria

- Intelligence - how does it incorporate machine learning, data analytics, Fuzzy-logic, AI rules, and innovation?

- Strategy - how good the ETF portfolio strategy is in terms of discipline, theme, diversification, scheduled rebalancing, and intelligent trigger adjustment?

- Cost - what is the competitiveness of the ETF expense ratio?

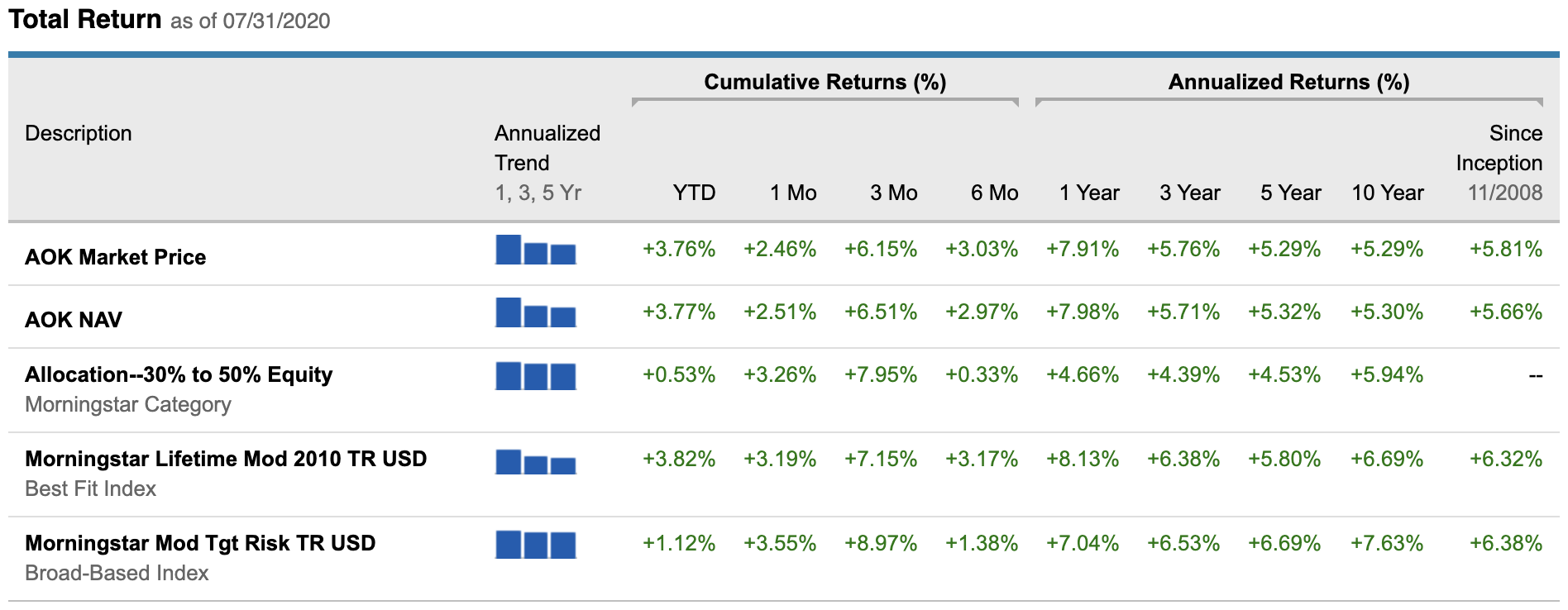

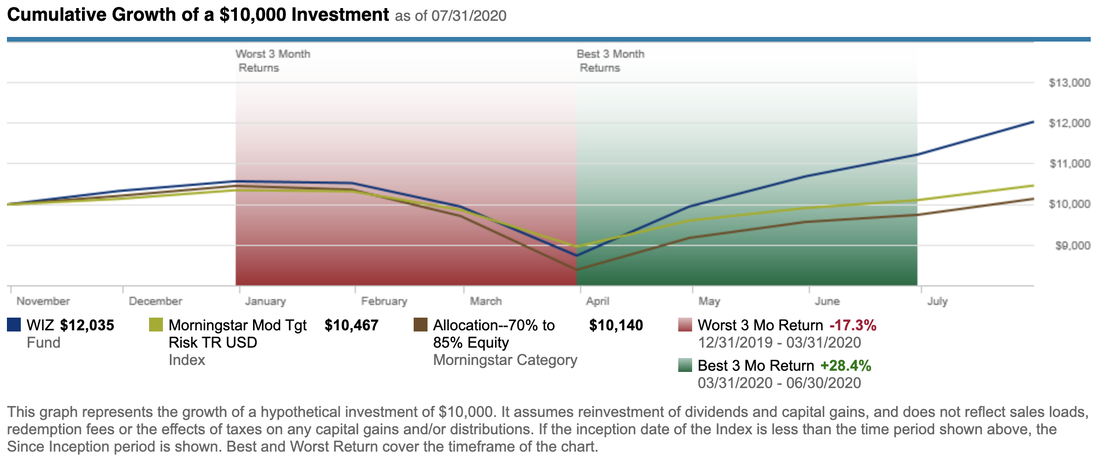

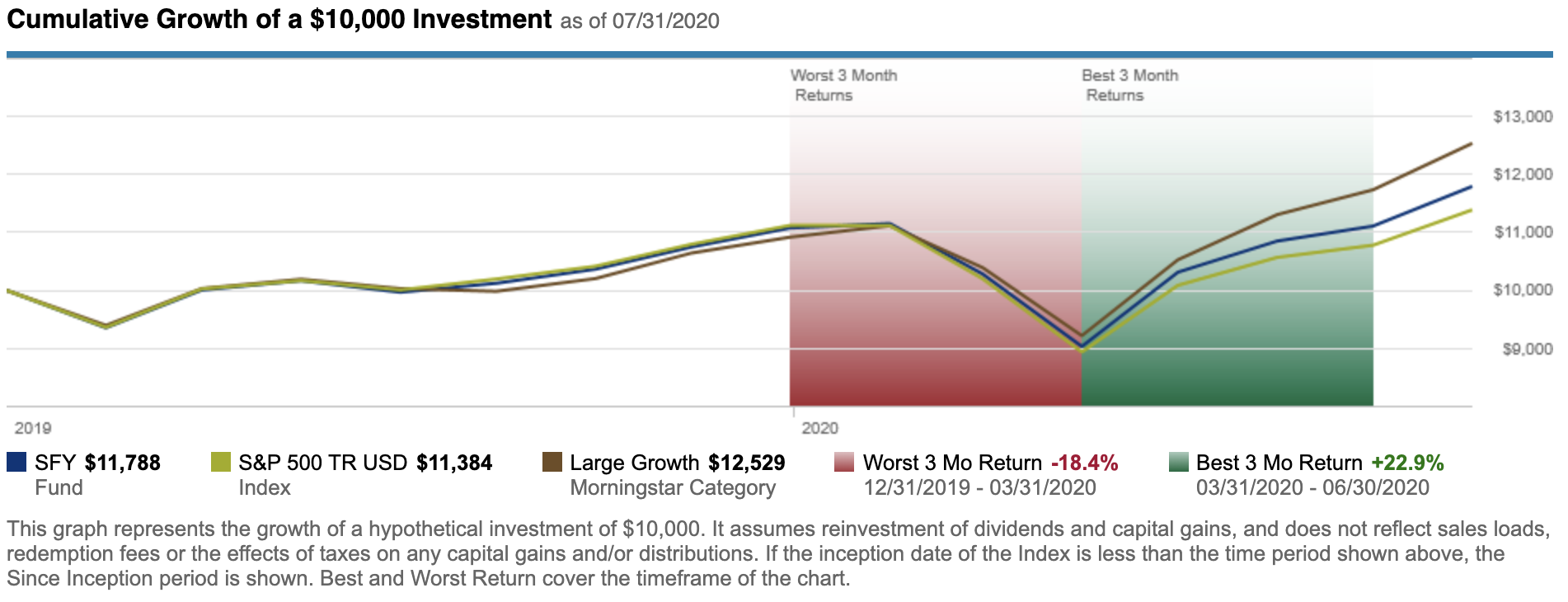

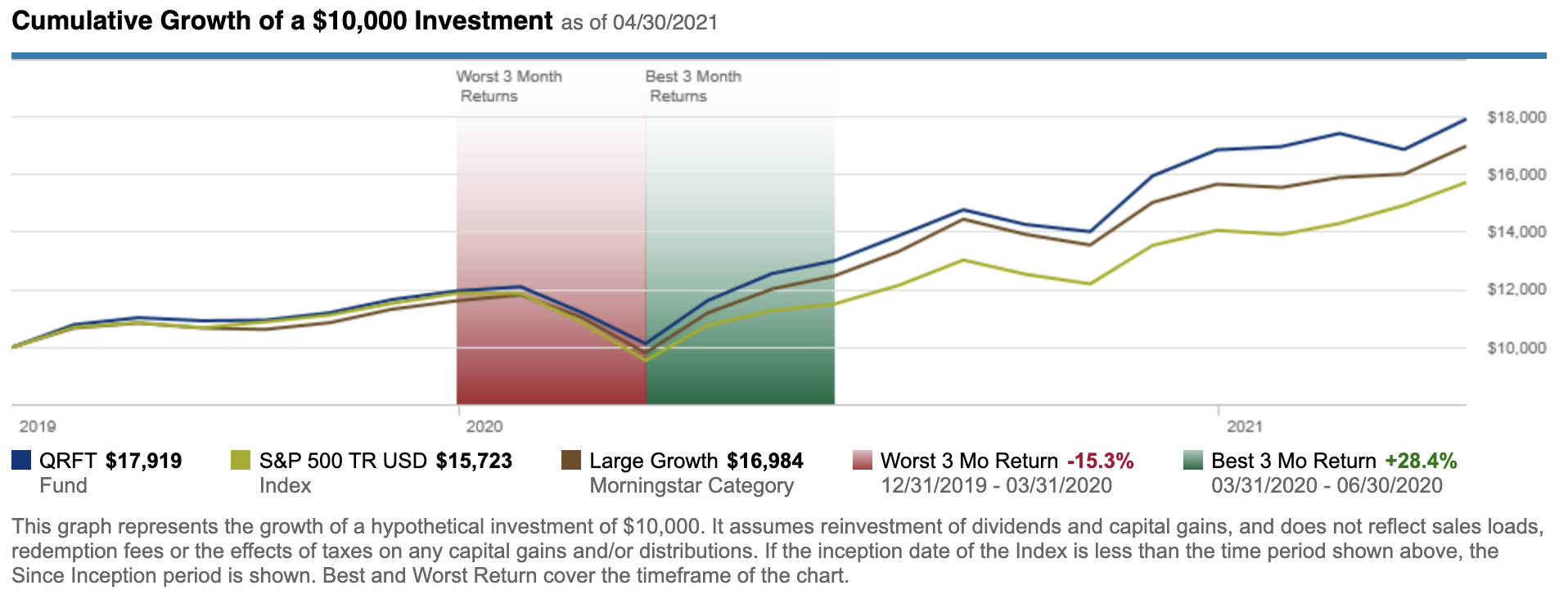

- Performance - what is the ETF historical performance as compared to the benchmark, upside capture, downside capture, maximum drawdown, and performance consistency?

- Correlation - how does the ETF price movement behave as compared to the major indices in up and down market conditions?

- Efficiency - how good is the ETF tax efficiency in terms of turnover of underlying ETFs?

- Liquidity - what is the ETF trading volume, bid-ask spread, tracking errors, AUM, and option availability?

- Institutional investors are increasingly interested in applying sophisticated trading strategies to launch actively managed ETFs.

- We are committed to helping investors and firms in researching, reviewing, and designing the best AI-powered ETFs.

- Please contact us at AFIEA (Advisory for Financial Innovation, Evaluation, and Assessment) for identifying the areas for improvement and designing better AI-powered ETFs for the future.

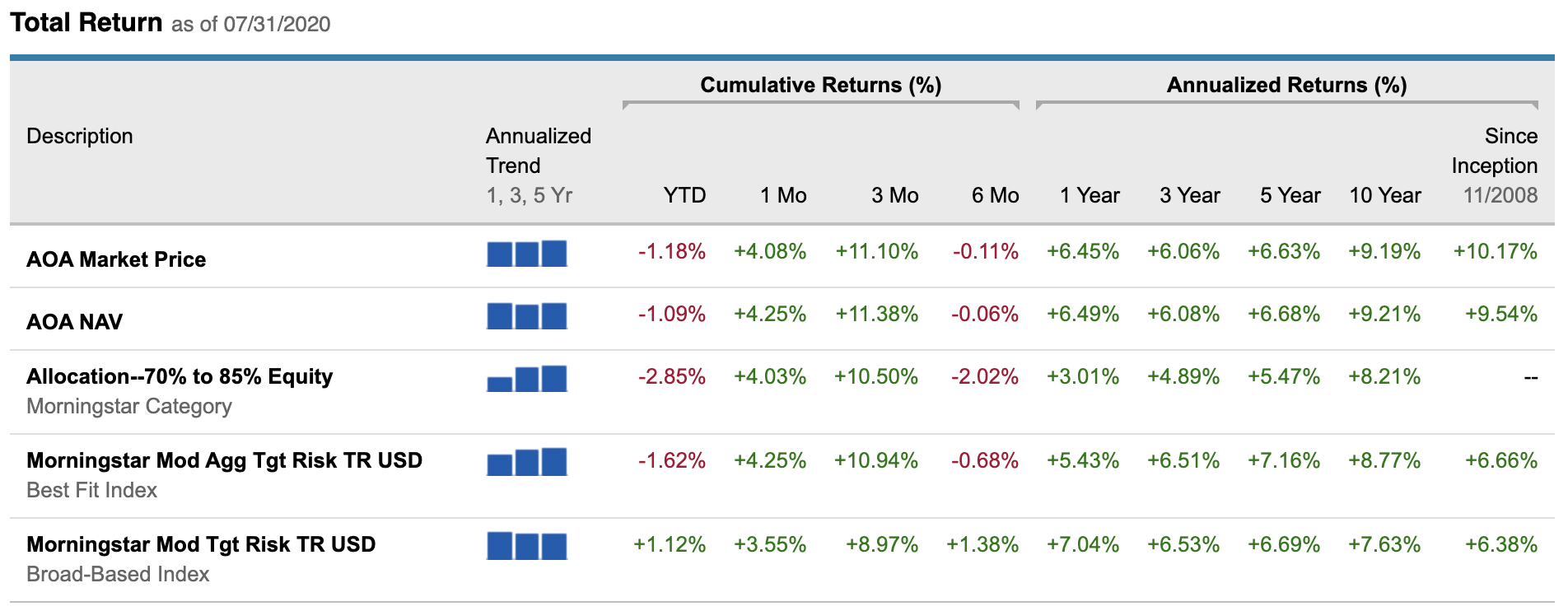

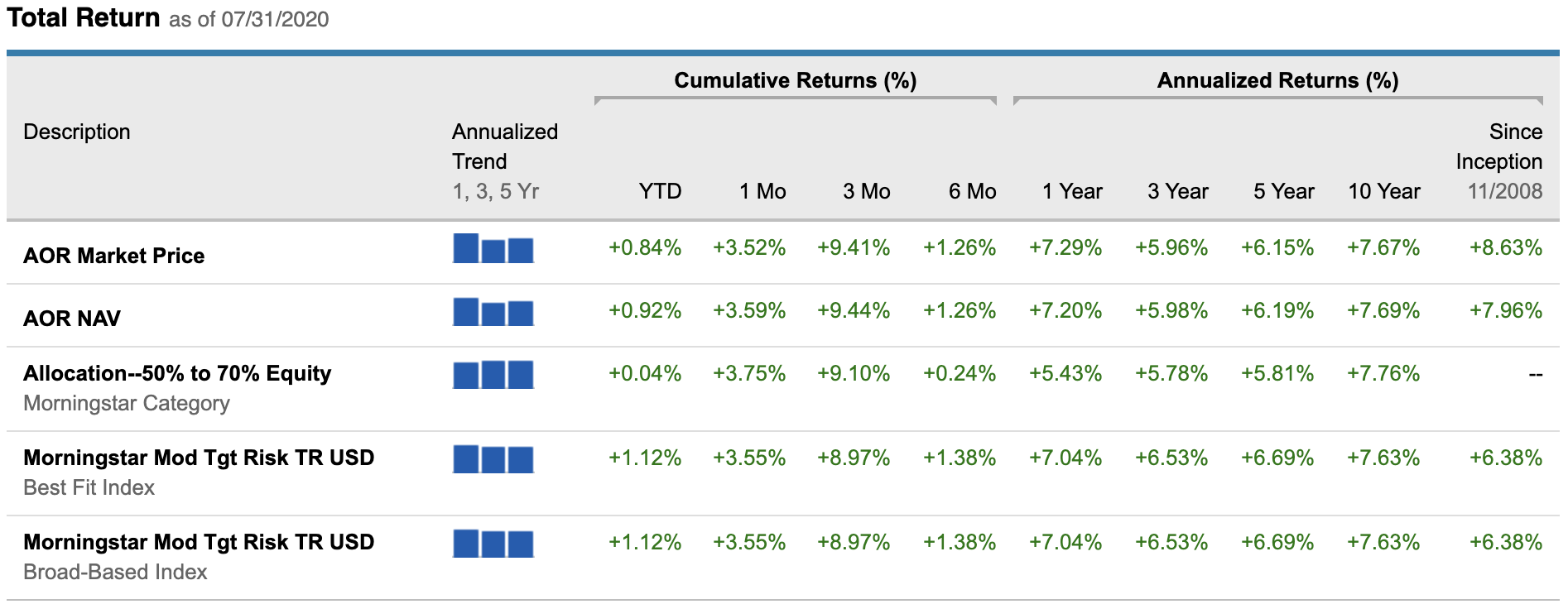

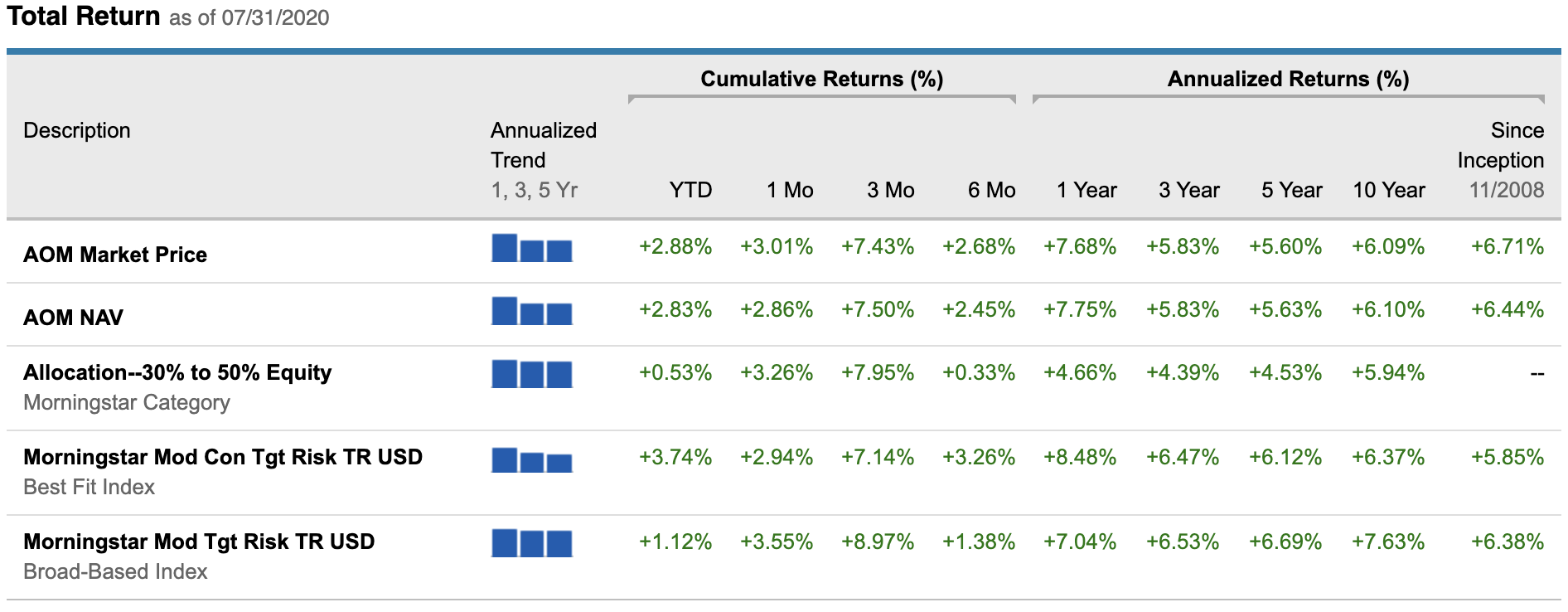

- Based on the above-defined Robo-advisor assessment criteria, we have analyzed and reviewed the following selected asset allocation ETFs and leading AI-powered ETFs available in the market today. Detailed analysis reports on each listed Robo-advisor are available to financial institutions upon request.