|

What is a Model Portfolio?

Model portfolios are a diversified group of assets designed to achieve an expected return with a corresponding risk. Ideally, each portfolio has a combination of intelligent and optimized managed investments based on extensive research. These portfolio blend asset classes, investment managers and investment strategies to achieve diversification.

Intelligent model portfolios offer retail and institutional investors the opportunity to realize returns outperforming the standard investment benchmark with low net annual operating cost often less than 0.2%.

Why should you use a model portfolio?

- Investment comes with expectations. The reality is that investors always seek high returns, low risk, tax efficiency, and even social responsibility.

- Investors are increasingly distrusting the actively managed portfolios due to higher cost and underperforming results.

- Therefore, one of the driving forces currently reshaping the financial services landscape is the increased usage of model portfolios utilizing low-cost ETFs as the engine for most Robo-advisory product designs and as the portfolio construction tools by advisors and fund managers.

How do you select a model portfolio?

- In the financial service industry, financial advisors or investment managers have started to offer a variety of model portfolios to correspond with investors' financial goals and objectives. If constructed properly, these model portfolios are designed to achieve benchmark-matching performance.

- Computing power and data analytics have made it possible to further improve model portfolios and create intelligent model portfolios with positive alpha. Alpha is the excess return of the portfolio over its benchmark for its expected risk.

- Our value-added intelligent model portfolios have all been time-tested to outperform the standard investment benchmark. They are ready-to-use ETF portfolios and available in serving investors with Growth Strategy, Income Strategy, and Global Strategy.

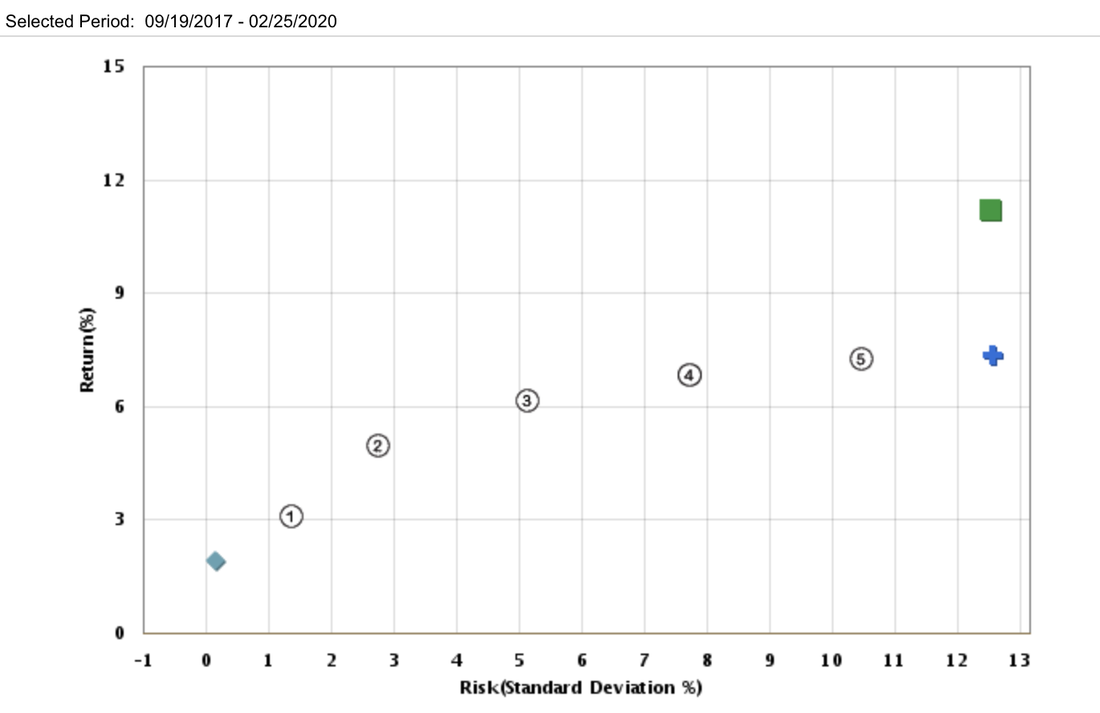

Safer Growth

Inception Date: 09/19/2017

Objective

Simple and diversified growth

Design Keys

High quality, growth and value balanced, diversified

Performance

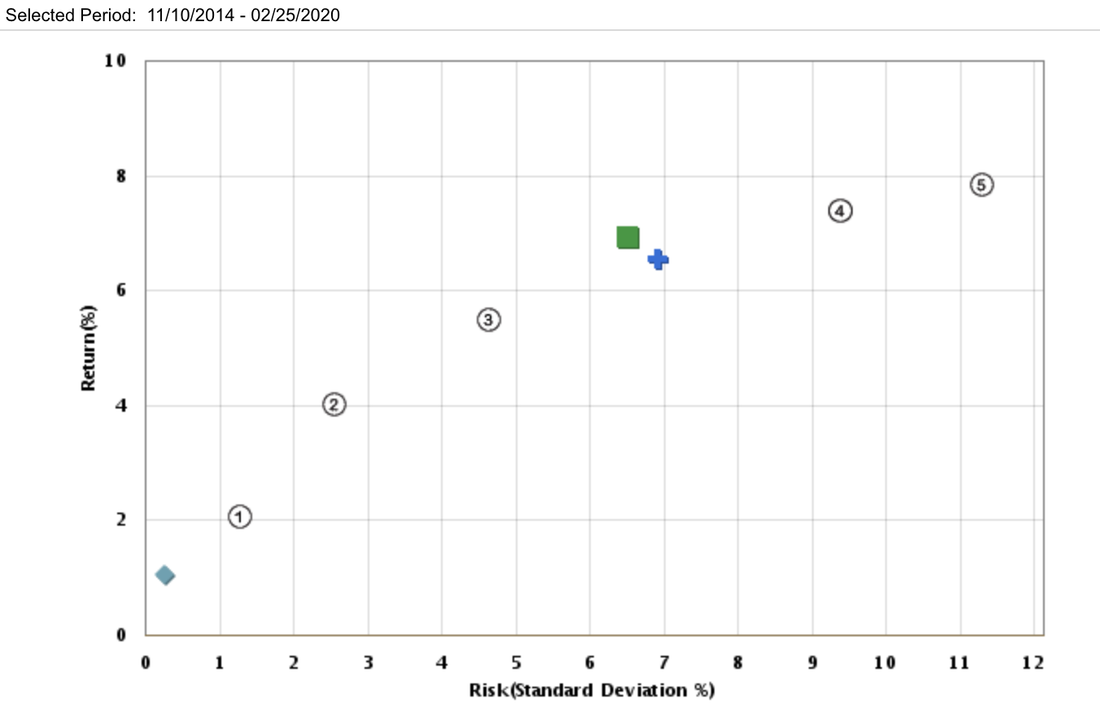

Symmetric growth

Inception Date: 11/10/2014

Objective

Inflation protected capital appreciation

Design Keys

Balanced and diversified

Performance

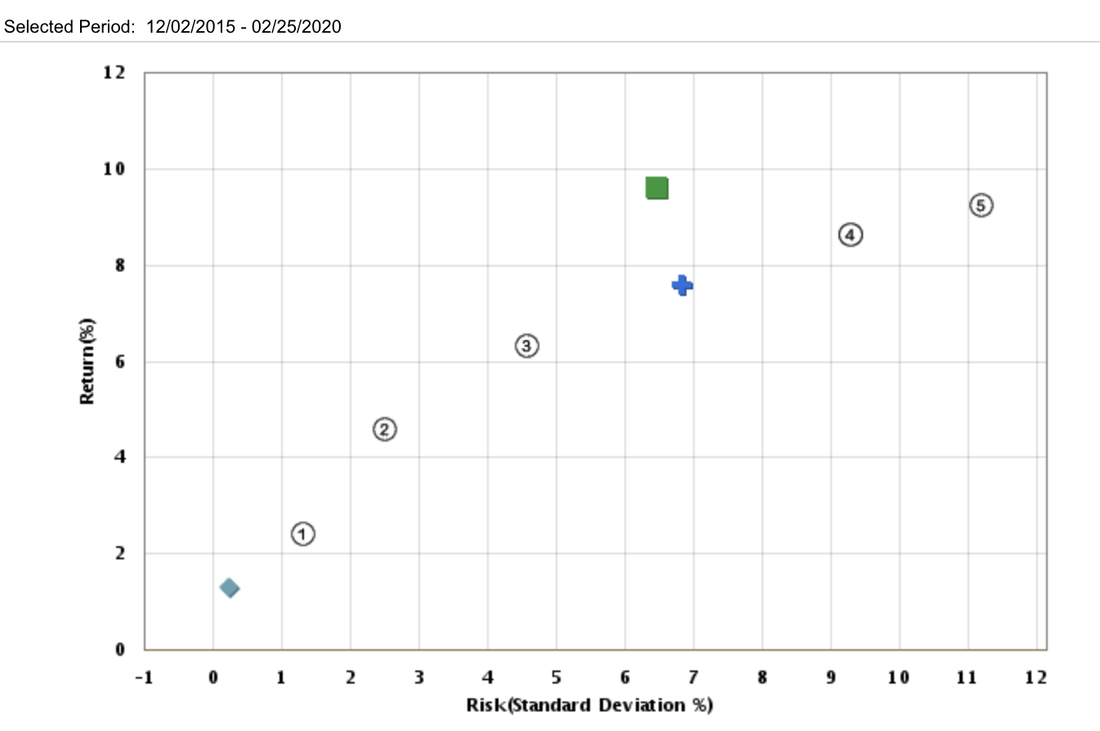

Superior Income

Inception Date: 12/02/2015

Objective

High income with low volatility

Design Keys

Diversified income with some capital appreciation and risk management

Performance

Social ESG Growth

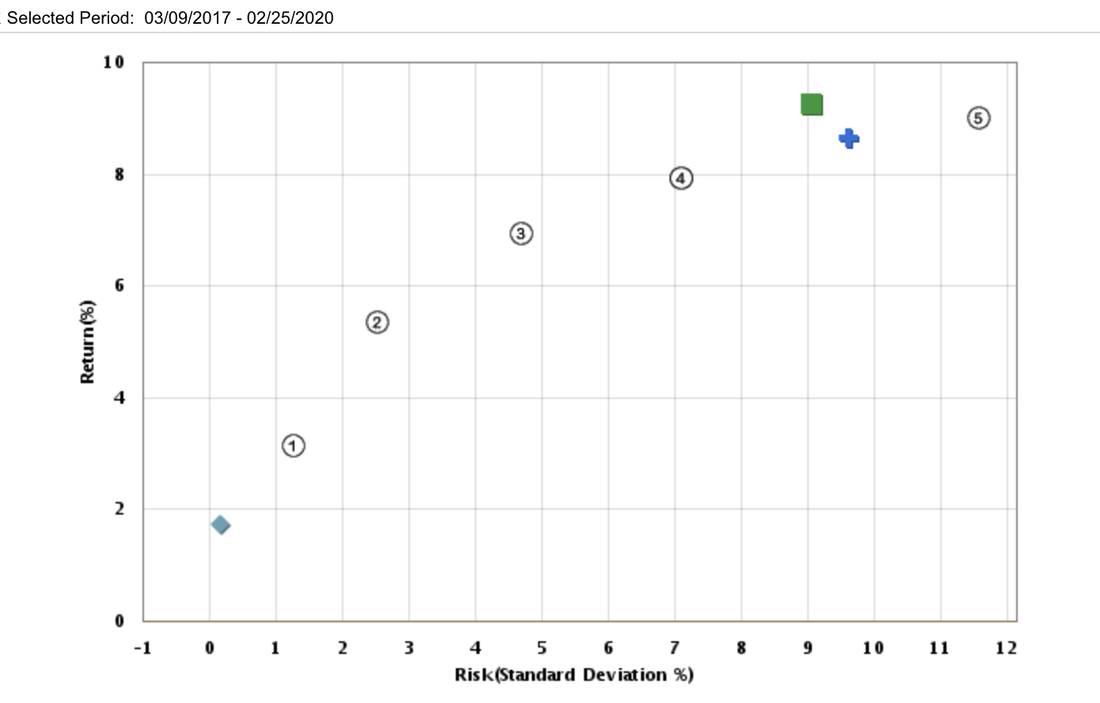

Inception Date: 03/09/2017

Objective

Socially responsible investing

Design Keys

Global diversification with ESG choices (Environmental, Social, and Governance)

Performance

Synergy Growth

Inception Date: 12/03/2015

Objective

High quality global growth

Design Keys

High quality, balanced, diversified

Performance

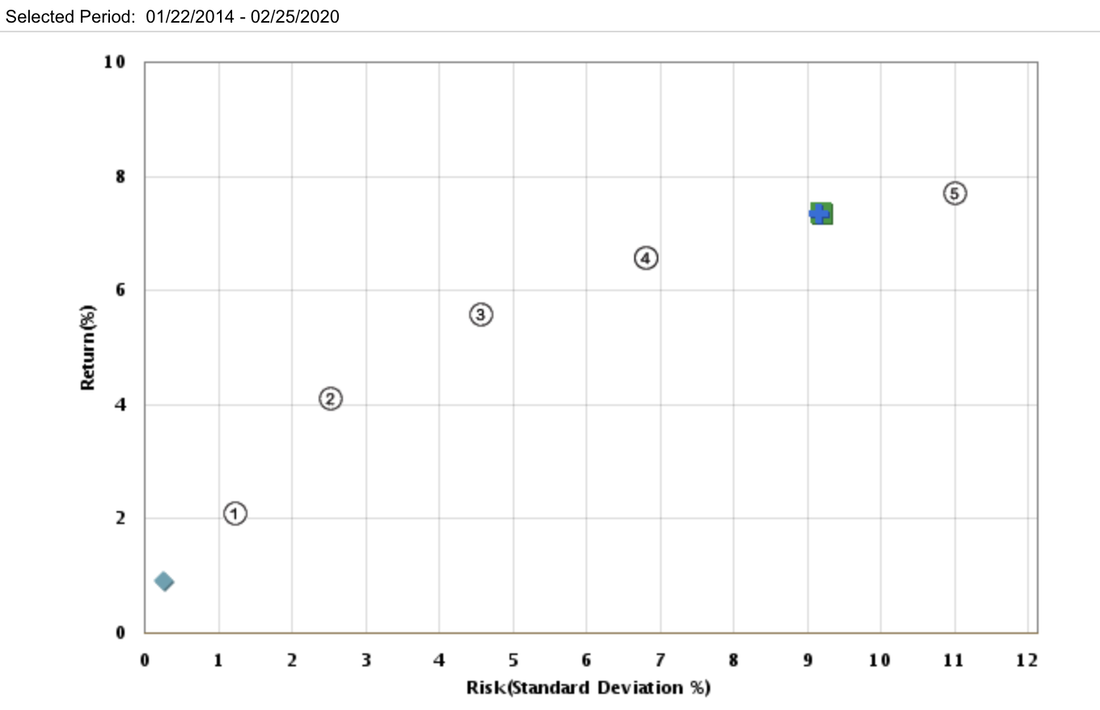

Systematic Growth

Inception Date: 01/22/2014

Objective

Benchmark-matching growth

Design Keys

Systematic mimic of benchmark index, diversified

Performance

Popular model portfolios:

Remarks: We encourage investors and advisors to look into these popular model portfolios and find out how these popular model portfolios compared to our Intelligent Alpha portfolios, why they have little intelligence, and why they often do not generate better performance as compared to benchmarks.

- Vanguard Model Portfolios

- Fidelity Model Portfolios

- Schwab Model Portfolios

- Interactive Brokers Model Portfolios

- BlackRock Model Portfolios

- Goldman Sachs Model Portfolios

- Morgan Stanley Model Portfolios

- J. P. Morgan Model Portfolios

- State Street ETF Model Portfolios

- Russell Investments Model Portfolios

- Capital Group American Funds Model Portfolios

- WisdomTree Modern Alpha® ETF Model Portfolios

- VanEck ETF Model Portfolios

- Franklin Templeton Model Portfolios